| PHONE TAXES ARE CELL HELL

'INSANE' GOV'T GRAB IN NY | |

| The

New York Post | April 13, 2009

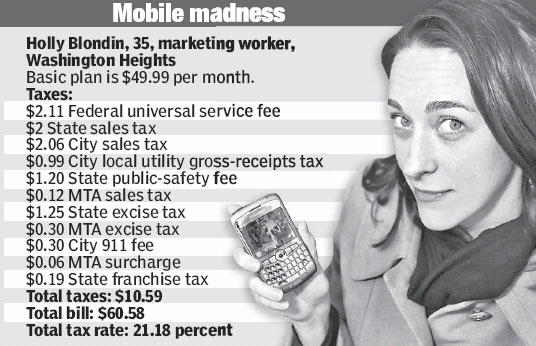

By Bill Sanderson and Amber Sutherland You can't hang up on the taxman. Eleven federal, state and city levies add as much as 33 percent to the

cost of New Yorkers' cellphones, a Post analysis found.

|

|

| A typical cell plan costing $49.99 a month comes with a

total tax bill of $10.59 -- a 21.18 percent tax rate that helps give New

York the fourth-highest cellphone taxes of any state.

And cheaper plans favored by the frugal and poor are taxed at higher rates. Someone with a $29.99 T-Mobile Basic plan with 300 minutes pays $6.95 in taxes monthly, a rate of 23.18 percent, 2 percentage points above the typical city bill. People trying to save money with multiline family plans are hit harder. Federal, state and local taxes on a two-line Sprint plan costing $69.99 a month add up to $15.73, a rate of 24.25 percent, 3 points above the typical bill. Sprint offers additional lines for $9.99 each. Add $2.89 in state and city taxes and 42 cents in federal taxes, and each extra $9.99 line carries a tax bill of $3.32 -- a 33.20 percent rate, 12 percentage points above the typical bill. "The taxes are insane!" cried Jessica Porter, 36, a gallery worker from the East Village with a similar three-line family plan. Cellphone customers gripe that there's no justification for some of the fees, such as the state's $1.20-per-line, per-month 911 charge. Responding to complaints that only a tiny amount of the tax went to 911 service, the Legislature voted this month to call it a "public-service fee" instead. "If there was a $5 monkey fee, even if they couldn't explain it, you would still have to pay," sniped Danny Schluck, 28, of Bushwick. New Yorkers' cellphone levies include a 4 percent state sales tax, a 4.125 percent city sales tax, and three MTA taxes that add up to 0.98 percent. Most people never read the phone-bill fine print -- they just pay up. That's exactly how elected officials like it, said Scott Mackey, an economist who tracks taxes for several cellphone companies and aided The Post's analysis. "There's a tendency to feel no one is going to notice this little tax," Mackey said. "They can do this without a lot of pushback from their constituents." |

|